Calculating car depreciation for tax purposes

Depreciation reduces your basis for figuring gain or loss on a later sale or exchange. To deduct car expenses under either method you must keep records that follow the rules in chapter 5 of Pub.

Car Depreciation Calculator

Edmunds True Cost to Own TCO takes depreciation.

. Calculate the cost of owning a car new or used vehicle over the next 5 years. If you do claim bonus depreciation the maximum write off is. Calculating car depreciation is nobodys first choice for a Saturday afternoon but taking the time to consider your options is worth every penny.

You can deduct depreciation only on the part of your property used for rental purposes. Tax Base is the amount attributed to the asset or liability for tax purpose. For tax purposes your cost basis in the pool route is 25000 22500 2500.

The cost of the car for depreciation is limited to the car limit at that time 59136 for the 202021 income tax year. If you choose to deduct your actual expenses in the year you start using your car for business you cant switch to the standard mileage rate later. Depreciation is calculated on a pro-rata basis.

Loan interest taxes fees fuel maintenance and repairs into. Therefore the tax base opening balance as per IT Act is. If you purchased a new vehicle during the tax year the IRS limits write-offs for passenger vehicles.

See section 404 of Rev. With these two methods you can do most of the accounting in India easily. If the business use percentage is only 50.

You buy a vehicle for 30000 and use it 100 for business. Your down payment a sum of money you pay upfront toward the value of your car. The depreciation rate as per the income tax act on vehicles car bike scooter a motorcycle that is not utilized for business purposes is 15.

The value of your trade-in if you have one the value of your existing vehicle which youll usually trade in at the. The higher your basis the less youll pay in capital gains tax when you sell. To calculate an auto loan you need to determine several factors.

The business cant claim the excess cost of the car. As the cost of the car is above the 59136 car limit for depreciation the business can only claim an instant asset write-off of 59136 for the year ending 30 June 2021. To determine depreciation deductions.

The business cant claim the excess cost of the car. Whereas if the vehicle is bought between 23rd August 2019 and 1st April 2020 and put to utilization before 1st April 2019 the rate of depreciation is 30. The MACRS system of depreciation allows for larger depreciation deductions in the early years and lower deductions in the later years of ownership.

To claim this tax deduction for the 2021 tax year the mortgage insurance contract must have been issued after 2006 and your adjusted gross income must be less than 109000 or 54500 if. For tax purposes the IRS generally considers five years to be standard for most vehicles. The price of the car you want to buy the price given to you by the dealership.

Some adjustments can increase your basis in an asset while others can reduce it and the latter generally is not a good thing at tax timeYou can increase your basis from there by adding the amount of money youve. In other words your car has the life expectancy of a guinea pig. TurboTax will show you the money-saving tax deductions you can take as a small business owner.

The maximum that can be deducted is 3160 in the 1 st year without the bonus depreciation 5100 in the 2 nd year 3050 and 3 rd year and 1875 in the 4 th and later years until the car is fully depreciated. For depreciation purposes there have been two transactions the purchase of the new car for 35000 and the sale of the existing car for 11000. For automobiles a taxpayer uses for business purposes the portion of the business standard mileage rate treated as depreciation is 24 cents per mile for 2015 24 cents per mile for 2016 25 cents per mile for 2017 25 cents per mile for 2018 and 26 cents per mile for 2019.

Calculating your adjusted basis in an asset begins with its original purchase price. Different methods are used because of different kinds of assets. Depreciation on a car will be different than depreciation on a manufacturing machine running 24 hours.

But we have seen what generally is followed in depreciation entries in tally and accounting as well. Pro-rata basis-It is calculated from the date of purchase of the asset to the end of the financial year. Calculating the Depreciation for a Vehicle.

In the first year if you dont claim bonus depreciation the maximum depreciation deduction is 10100. Depreciation calculation is done either full rate or half rate based on 180 days criteria. The Modified Accelerated Cost Recovery System or MACRS is the primary method of depreciation for federal income tax purposes allowed in the US.

Although only 24000 out of pocket she must add the car to the small business pool as it cost 35000 exceeding the relevant instant asset write-off threshold of 30000. The cost of the car for depreciation is limited to the car limit at that time 59136 for the 202021 income tax year. Depreciation as per Income Tax Act 1961.

As the cost of the car is above the 59136 car limit for depreciation the business can only claim an instant asset write-off of 59136 for the year ending 30 June 2021. How to Calculate an Auto Loan. An asset with a cost Rs 150 has a carrying amount of Rs 100.

You can divide the cost between them based on. For tax purposes depreciation is an important measurement because it is frequently tax-deductible and major corporations use it to the fullest extent each year when determining tax liability. Cumulative depreciation for tax purposes is Rs 90 and the tax rate is 25.

Beautiful Tire Shop Business Card Check More At Https Limorentalphiladelphia Com Tire Shop Business Card

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Depreciation Of Vehicles Atotaxrates Info

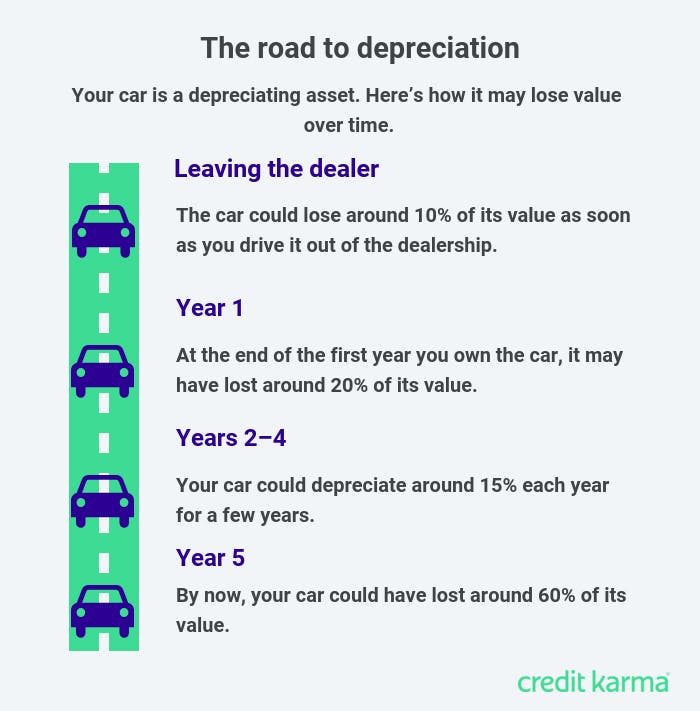

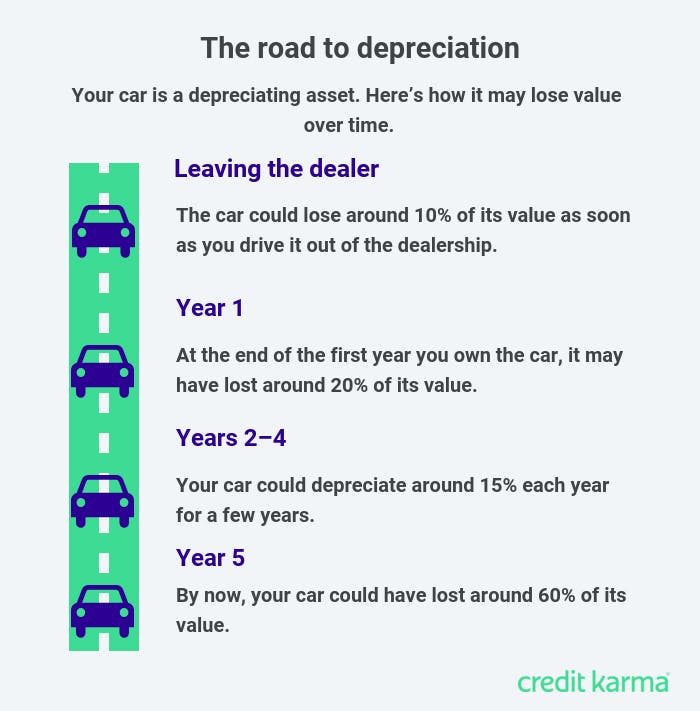

How Car Depreciation Affects Your Vehicle S Value Credit Karma

Depreciation In Income Tax Accounting Taxation Income Tax Income Energy Saving Devices

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Car Depreciation Calculator Calculate Straightline Reducing Balance Automobile Depreciation Rates Vehicle Values

How Is Car Depreciation Calculated Credit Karma

20 Biggest Business Tax Deductions Business Tax Deductions Business Expense Small Business Plan

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

How Car Depreciation Affects Your Vehicle S Value Credit Karma

.png)

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Car Depreciation For 1099 Contractors And Car Sharers

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Business Tax Deductions Tax Deductions Small Business Tax Deductions